When determining how much coverage your commercial property insurance policy should have, it’s critical not to underestimate the value of your property, contents, and inventory.

It’s also vital to understand how co-insurance clauses can affect your property policy and coverage for any loss of income you suffer following an insurable loss, such as a fire.

Co-insurance is an agreement between you and your insurance company. Essentially, it’s part of your insurance contract where you agree to maintain your property coverage limit up to the total value to replace it or a stated percentage of the property’s replacement value (usually 80% or 90%).

The purpose of co-insurance is to share the risk between a policyholder and the insurance company. It’s designed to ensure a policyholder maintains a proportionate amount of coverage relative to the property’s actual cash value or replacement cost.

Download Our FREE Insurance Guide

Learn everything you need to protect your small business.

Whitepaper download

"*" indicates required fields

Your email address will be used by Zensurance to provide latest news, offers and tips.

You can unsubscribe at any time.

Related Posts

Sign Up for ZenMail

"*" indicates required fields

Categories

Insurers base your annual premium on the understanding that your commercial property insurance coverage limit is adequate. Note: The coverage limit for a building you own is the cost to rebuild the structure, not its “market” value.

A co-insurance clause is a provision commonly found in commercial property insurance policies. It is designed to encourage policyholders to insure their properties to their full value.

Meanwhile, the coverage limit for your contents is the amount it costs to replace all your property should it be destroyed – everything from inventory, office equipment, computers, point-of-sale (POS) systems and light fixtures to your furniture, external store signage and any alterations to the commercial property you may lease (also known as tenants improvements) .

How Does Co-Insurance Impact Your Business When Filing a Property Damage Claim?

If and when a loss happens, and after you file a claim, a loss adjuster appointed by your insurer will assess the amount of coverage you have and compare it with what it would cost to rebuild or replace the property and your business contents.

If your coverage limit is within the agreed co-insurance percentage requirement as outlined in your policy documents, your loss should be paid in full, up to the policy limits minus any deductibles that may apply.

However, if your coverage limit is below the percentage stated in your policy, you and your insurer will then share the expense of the loss.

How Does Co-Insurance on Commercial Property Insurance Work?

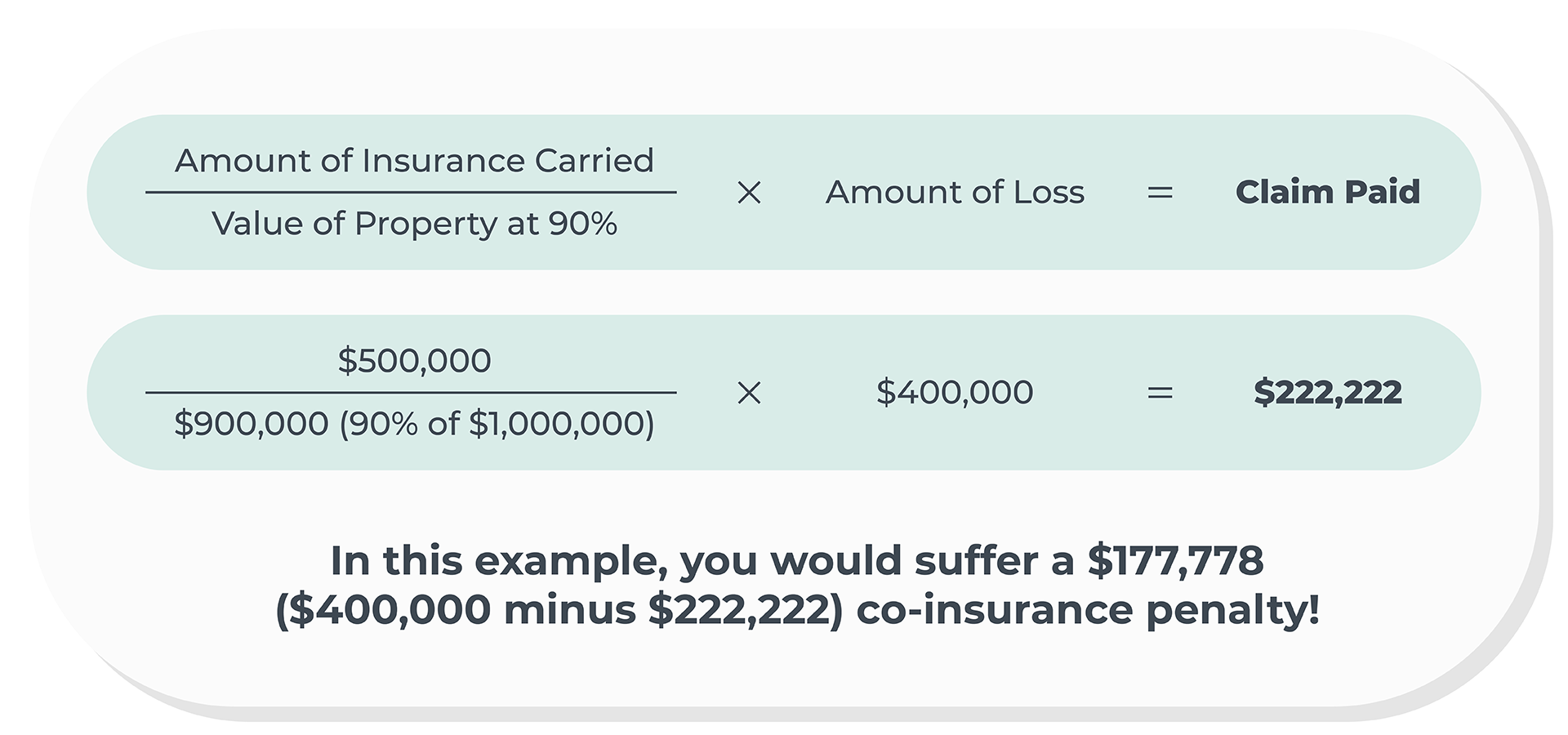

Here’s an example to illustrate how a co-insurance clause on your commercial property insurance policy works:

Let’s assume the value of the commercial property you want to insure is $1 million, and the insurance policy contains a 90% co-insurance clause. That means the amount of property insurance coverage you need is at least $900,000.

Now, if you only bought business property insurance with a $500,000 coverage limit, and a fire rips through your building, inflicting $400,000 worth of damages to the property and your contents, you would suffer a $177,778 co-insurance penalty. Your insurer would only cover $222,222 for the damage claim because you neglected to maintain the required 90% value of property coverage as per your policy’s details.

How to Avoid a Co-Insurance Penalty Before Filing a Property Damage Claim

There are a few steps you can take to avoid being hit by a co-insurance penalty by your insurer after filing a property damage claim, including:

-

Know What Your Policy’s Co-Insurance Percentage Is

Know the co-insurance percentage specified in your insurance policy documents. If you need help finding that information or need help reading your policy documents, get in touch with us.

-

Maintain and Update Your Commercial Property Coverage

Ensure your business property insurance coverage meets or exceeds the co-insurance percentage outlined in your policy. Review your policy annually and update your coverage as required. A Zensurance broker can help you do that.

-

Keep Accurate Documents of Property Improvements and Renovations

Keep detailed records of any improvements or renovations you make to the property. That documentation can help determine and justify increased property coverage limits.

-

Talk to Your Business Insurance Broker

A licensed business insurance broker works for you. They are your trusted advisors when buying, updating, and renewing a business insurance policy or if you need to file a claim for damage or loss. Get a Zensurance broker’s guidance on how much coverage you need for your small business to avoid the possibility of a co-insurance penalty after filing a claim.

How to Get the Adequate, Low-Cost Business Property Insurance You Need

Buying a commercial property insurance policy (or any business insurance) needs to be affordable and reflect your liability risks accurately. Otherwise, it’s unlikely you’re receiving actual value for your investment, and you could be putting yourself at risk of a co-insurance penalty.

Let us help you avoid that unpleasant scenario. Fill out our online application for a free quote. Our knowledgeable, licensed brokers can get the low-cost coverage your business needs and customize it to ensure your finances and assets are adequately protected.

Recent Posts

Is Your Salon Ready for the Holidays? Insurance Tips for Beauticians

Salon owners and independent beauticians need to stock up on the products they need to make their clients shine over the holidays. But ensuring they're adequately covered with customized insurance is also critical. Here's what to know.

10 Tips for Closing Your Small Business for the Winter

Are you closing up shop for the winter? Ensuring your property is prepared for winter and your valuable contents and inventory are safely stored is vital. See our tips for how small business owners can shut down operations and keep their assets safe.

Insurance Considerations for E-Commerce Businesses During the Holidays

With the busiest shopping season of the year underway, online retailers and e-commerce businesses need to be vigilant to prevent data breaches and cyber-attacks and get coverage for customer injuries. Here’s how insurance can help.