How prepared is your small business to withstand and recover from a flood, wildfire, earthquake, or severe windstorm?

Adeptly handling unexpected emergencies and natural disasters and ensuring the continuity of your small business requires thoughtful, in-depth planning. That’s the aim of Public Safety Canada’s annual Emergency Preparedness Week – raising awareness to help Canadians be ready to tackle emergencies by identifying local hazards and taking action to minimize those risks.

Emergency Preparedness Week 2024 runs from May 5 to 11. Being prepared to manage disruptions and unexpected events is a year-round effort. However, the first week of May offers an opportunity to learn about what actions your small business can take to reduce the risks you face.

With that in mind, here are 10 emergency preparedness tips for small business owners to consider:

Download Our FREE Insurance Guide

Learn everything you need to protect your small business.

Whitepaper download

"*" indicates required fields

Your email address will be used by Zensurance to provide latest news, offers and tips.

You can unsubscribe at any time.

Download our emergency kit checklist

Related Posts

Categories

1. Know the Risks

Each province or region in Canada is subject to various hazards, including floods, wildfires, tornadoes, hurricanes, earthquakes, blizzards, and heavy snowfall.

Identify the natural disasters most likely to affect your business and community, and stay up to date on weather reports and government advisories where you’re located.

2. Create a Business Continuity Plan

As a small business owner, you appreciate the necessity of thoughtful planning and strategizing. Apply the same approach to creating a business continuity plan for your business. Keep it simple and easy to follow. Do a risk assessment of the potential threats your business faces and outline the steps to be taken in different situations. For instance, have a list of actions if there’s a flood and another list if there’s a wildfire.

Detail what to do, who should do it, and how. Have contact information for all employees, business partners and providers, and emergency responders in your community. Identify another location to run your business if you need to vacate your commercial property temporarily.

Once your plan is drafted, print three copies and store them in secured locations elsewhere (a fireproof safe, your home, and a business partner’s or trusted friend’s place). Maintain a digital copy stored in the cloud that you and your employees can access on mobile devices or laptops.

3. Create a Communications Strategy

Communication is critical for informing employees, suppliers, and customers during a crisis. Draft a crisis communications plan as part of your disaster recovery strategy. Include an updated emergency contact list with every possible way of reaching each employee by phone, email, and social media. Think of how you’ll inform employees, customers, partners, and suppliers, for instance, by email or text messages.

If your company uses social media networks like X (formerly Twitter), Instagram, and Facebook, include them in your plan. Follow @Get_Prepared on X and Emergency Ready in Canada on Facebook for tips and information on what to do before, during, and after an emergency.

Also, think about the messaging you need to have in place for communicating to employees, partners and suppliers, customers, and the public. Lastly, ensure your employees have access to the communications plan and understand what roles they have to play within it.

Remember that your cell phone service may not operate as smoothly during significant emergencies or natural disasters. It’s recommended to use non-voice channels for communications in an emergency, like texting, emailing, and social media channels, as they use less bandwidth than voice calls.

4. Identify Your Company’s Mission-Critical Operations

As part of your business continuity plan, you’ll need to detail your company’s mission-critical systems.

Think about your computing systems, servers, and software, and what to do if your network goes down and you have no internet access. That likely means you’ll need network documentation, like a blueprint of your company’s software, data, computing systems and hardware. Having network documentation will make restoring your network and critical systems faster, easier, and possibly cheaper.

Also, establish the ability to remotely access your network so you and your staff can continue to manage the business online from wherever you are. If you have an IT technician on your team or an independent IT consultant who services your business, ensure they have remote access and are included in your network documentation and overall business continuity plan.

5. Train Your Employees

Ensure your employees know your business continuity plan and how to access it. Train them on what to do if you cannot be contacted and they need to execute the plan.

6. Backup Your Data

Always back up your data regularly and consistently and maintain copies on different servers at a secure, offsite location and in the cloud. Automating your data backups is wise, so you don’t need to worry about doing it yourself every day.

Moreover, ensure you have cyber insurance as part of your overall policy. It covers costs associated with cybercrime involving your technology systems and customer data.

7. Take Preventative Measures to Protect Your Property

Be proactive and take steps to protect your commercial property from the threat of fire, flood, and severe weather. For example, ensure you have a 24/7 monitored alarm system that includes fire and water detection, install storm shutters over windows, and secure any inventory outdoors to prevent them from becoming projectiles in a windstorm.

8. Test and Update Your Plan Annually

After creating a business continuity plan, test it at least annually and update it. Run different scenarios with your employees and partners to see how it works. That way, you can identify holes in your plan that must be addressed. Testing the plan will also help ensure your employees understand what they need to do in an emergency.

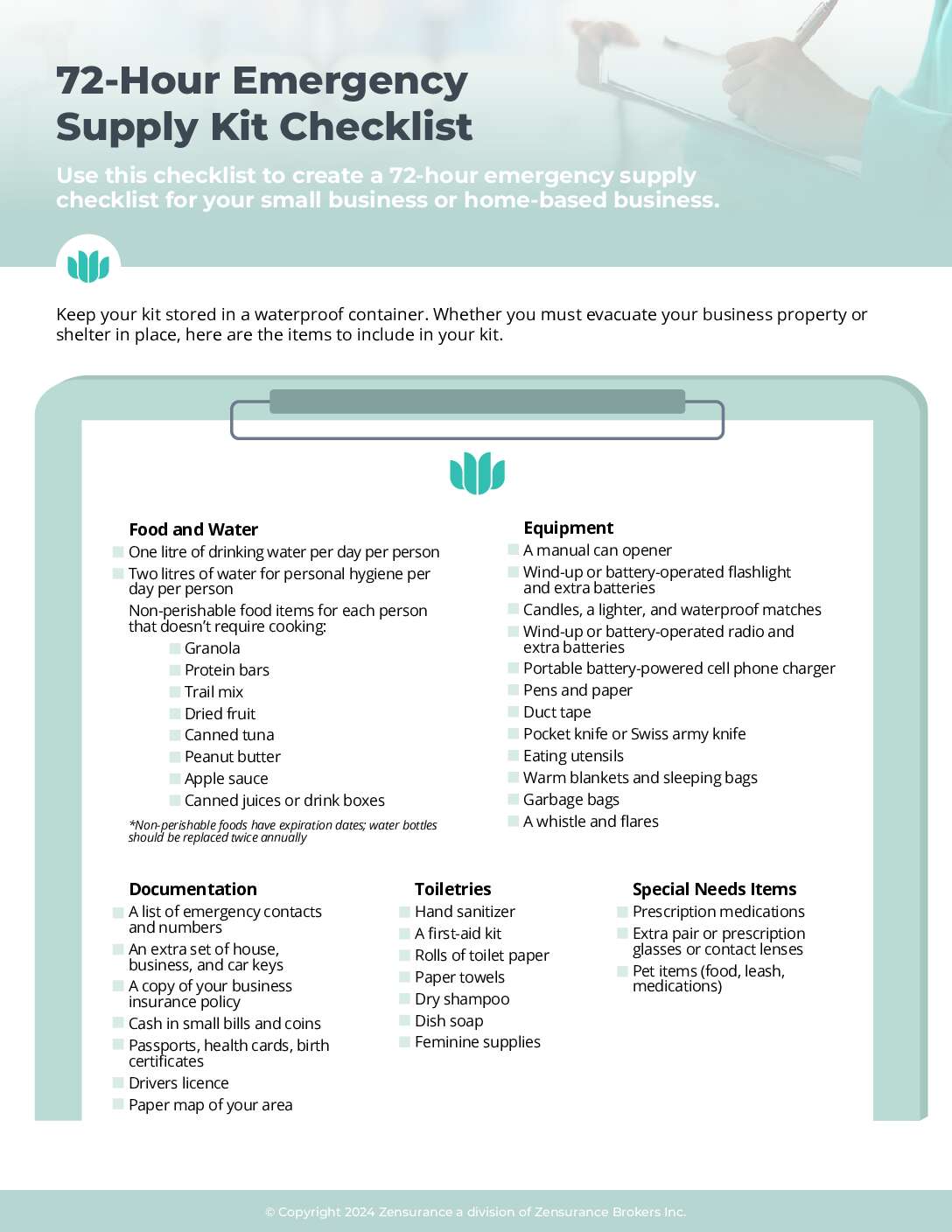

9. Assemble a 72-Hour Emergency Supply Kit

Buy a first-aid kit and assemble emergency supplies that will last for up to 72 hours, including water, non-perishable food, a manual can opener, candles and matches, a battery-powered flashlight, extra batteries, and cash.

Download for free our emergency kit checklist as you assemble your business’s kit.

You can also purchase a 72-hour emergency kit from retailers or the Canadian Red Cross.

10. Review Your Business Insurance Policy

It’s wise to review your company’s business insurance policy annually to ensure you’ve got the coverage you need for your property, products, and services.

In the spirit of Emergency Preparedness Week, it’s a good time to talk to a Zensurance broker and review your existing policy to see if you need to add or change it. Or, if you’re considering switching insurers or brokers, we can help you do that quickly and easily as well.

Additional Emergency Preparedness Resources for Small Businesses

Each province and territory has an emergency management organization that can provide you with information and resources for preparing for emergencies as well as disaster financial assistance programs:

- Alberta Emergency Management Agency

- B.C. Public Safety and Emergency Services

- Manitoba Emergency Measures Organization

- New Brunswick Emergency Measures Organization

- Newfoundland & Labrador Justice and Public Safety

- Northwest Territories Municipal and Community Affairs

- Nova Scotia Emergency Management Office

- Nunavut Emergency Management

- Emergency Management Ontario

- P.E.I. Emergencies and Public Safety

- Quebec – Ministère de la sécurité publique

- Saskatchewan Public Safety Agency

- Yukon Emergency Measures Organization

Insurance Can Help Your Business Recover From Disasters

Among all the preparations and actions you take to prepare for emergencies and protect your commercial property from damages, the backbone of your company’s risk management strategy is a comprehensive business insurance policy.

Small businesses and self-employed professionals are at particular risk as they often lack the resources to survive a catastrophic event. And when small businesses are unable to rebuild, the entire community suffers.

Make the most of Emergency Preparedness Week this year by strategizing and preparing your company and employees to be ready to deal with the impact of a natural disaster or extreme weather.

It’s also wise to speak to a Zensurance licensed broker about your existing policy to ensure you’re adequately protected or shop around for the policy you need at a better price, at least annually.

We can help you do that. Fill out an online application for a free quote. We’ll shop our network of over 50 insurers to get you the low-cost insurance you need.

– Updated May 3, 2024.

Related Posts

How to Prevent Phishing Attacks

Phishing attacks are among the most pervasive cyber-attacks against small businesses and independent professionals. Learn more about it and how to prevent your company from falling prey to it.

Zensurance Business Grant Winner 2024: Down East Dance Academy

Meet our $10,000 and $1,000 small business grant winners, their advice for other business owners and entrepreneurs, and why insurance is an essential part of their financial wellness.

5 Common Winter Business Insurance Claims

Accidents and mishaps leading to insurance claims can happen to any business owner at any time, but winter weather can raise the stakes considerably. Here are five wintertime claims our clients had to contend with and how their insurance coverage helped them recover.