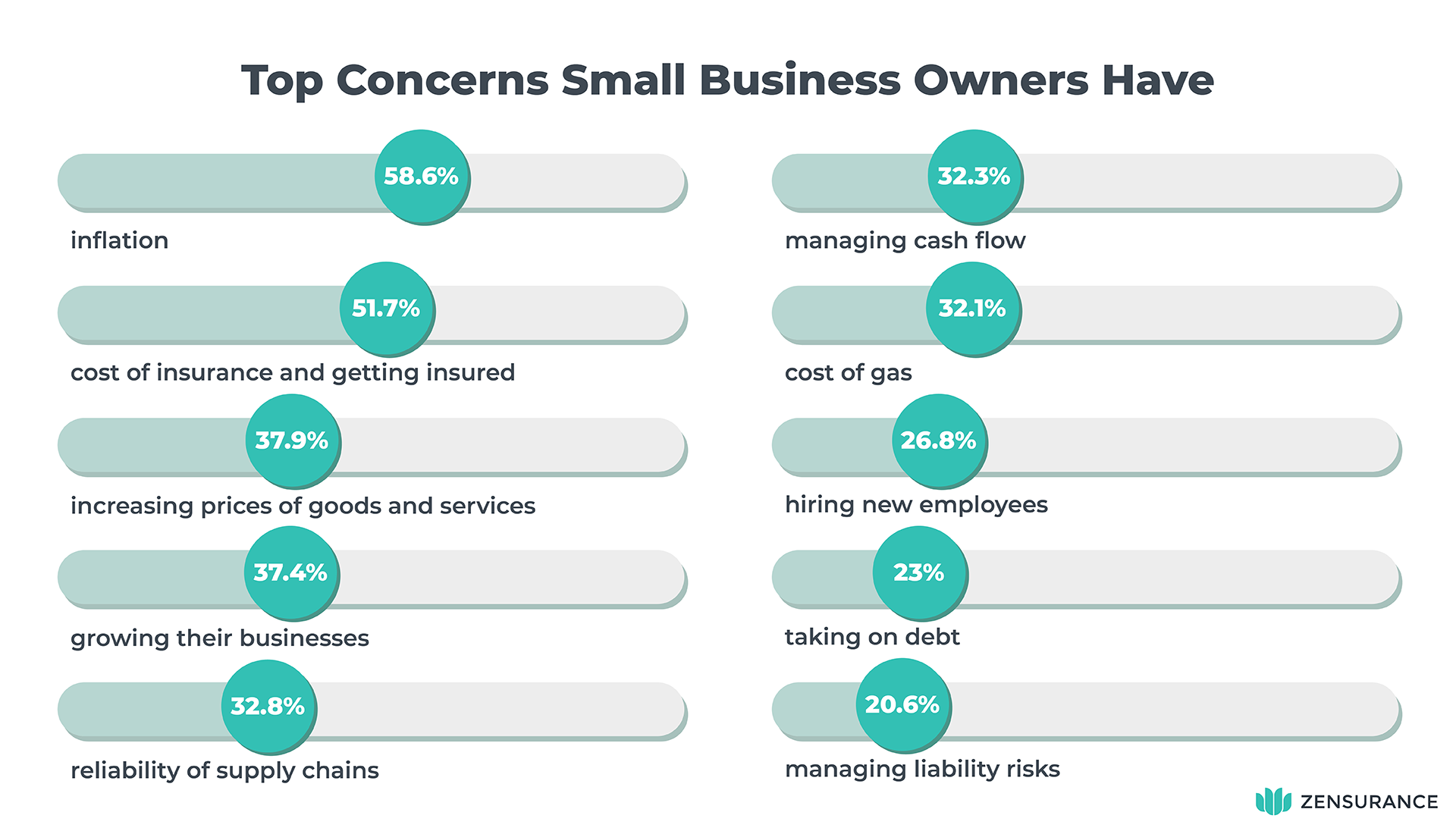

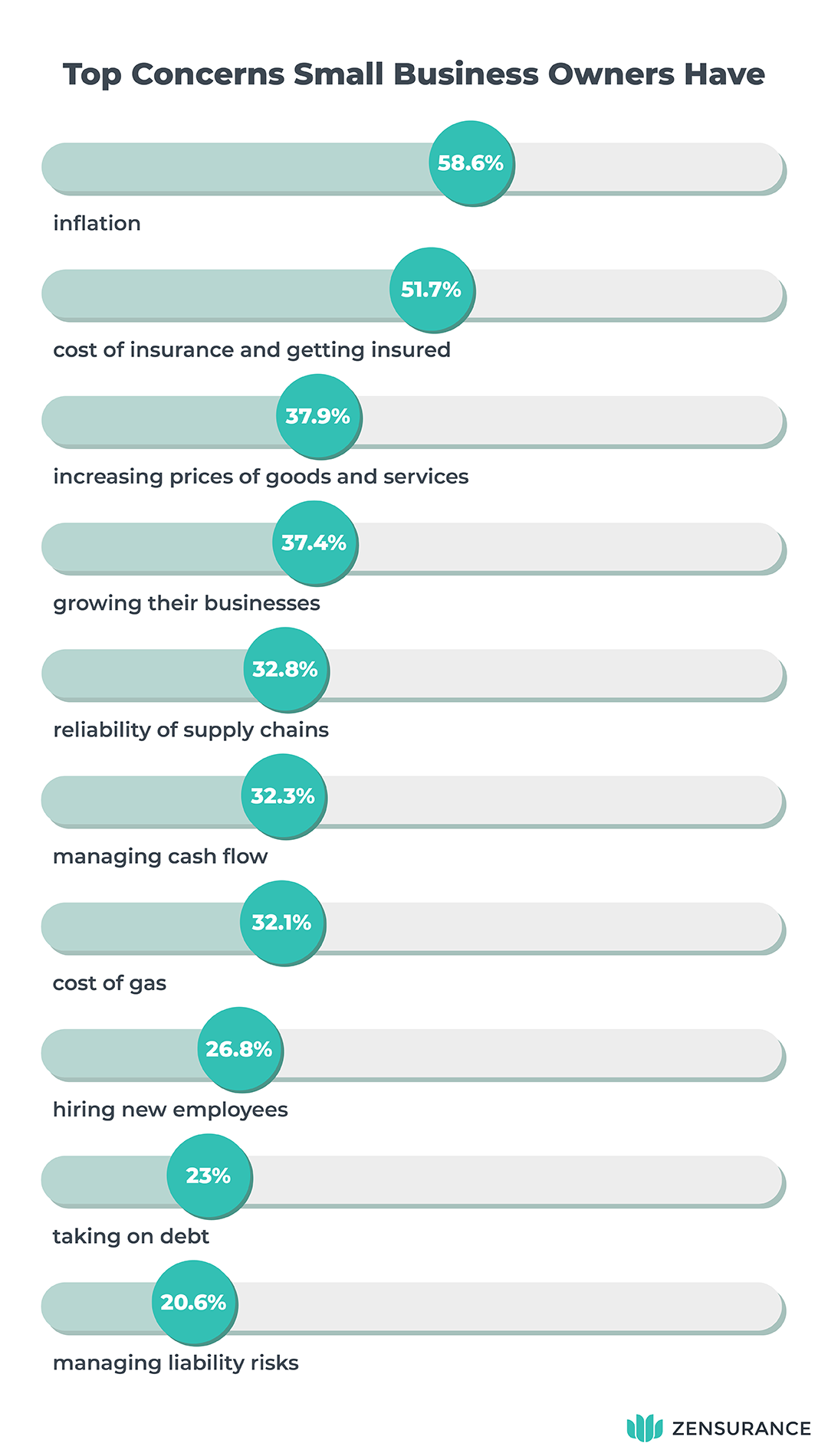

According to the third annual Zensurance Small Business Confidence Index survey, inflation (58.6%), the cost of business insurance and getting insured (51.7%), and what will happen with interest rates (39.6%) are among the top concerns Canadian small business owners have in 2024.

However, despite these concerns, a majority (69.9%) are “very confident” (36.4%) or “somewhat confident” (33.2%) that their businesses will be successful in 2024, while 14.9% are neutral. A combined 15.5% are “not very confident” (8.5%) or “not at all confident” (7%).

Download Our FREE Insurance Guide

Learn everything you need to protect your small business.

Whitepaper download

"*" indicates required fields

Your email address will be used by Zensurance to provide latest news, offers and tips.

You can unsubscribe at any time.

What’s behind the majority’s upbeat perspective? The answer may lie in how their business revenues have fared in the first half of 2024, with a combined 58.5% saying their revenues have either “soared to new heights” (19.9%) or “have improved moderately” (38.6%) compared to 2023. Another 22.3% say their revenues in the first six months of this year are comparable to the same time frame last year, but 11.2% say their revenues have taken a downturn versus 2023, and 8% say their revenues have plummeted to their lowest level in five years.

And yet, when asked how the current state of the economy has affected their revenues in the first half of 2024, a combined (36.6%) of this year’s respondents said the economy has had a negative impact on their businesses, 26% said it’s had a moderately negative impact, and 10.6% said it’s had a significantly negative impact.

However, 22.5% of business owners said the economy has had little to no impact on them, and 21.1% said it’s had a significantly positive impact on their bottom lines or a moderately positive (19.8%) effect.

The national online survey of 1,000 small business owners and independent professionals also found:

- 37.9% are concerned about increasing the prices of the goods and services they provide

- 37.4% say they are concerned about growing their businesses

- 32.8% worry about the reliability of their supply chains

- 32.3% say managing cash flow is worrisome

- 32.1% identify the cost of gasoline as a concern

- 26.8% see challenges with hiring new employees

- 23% fret about taking on more debt to grow their businesses

- 20.6% identify managing their liability risks as their top concern

What Canadian Business Owners Think About Protecting Their Finances With Insurance

We asked business owners if they had commercial insurance. The majority (66.4%) of our survey respondents say they do have business insurance, however, 33.6% do not.

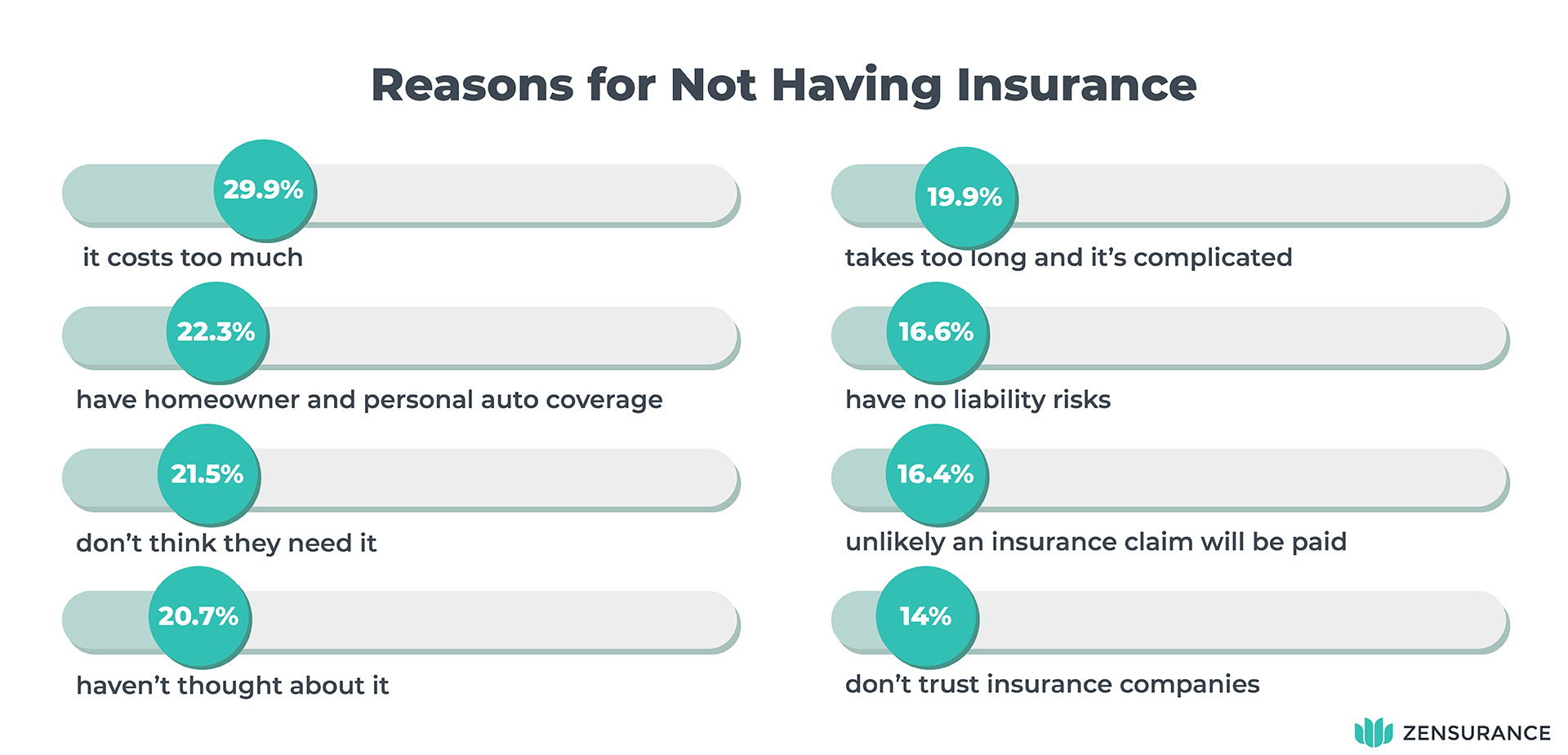

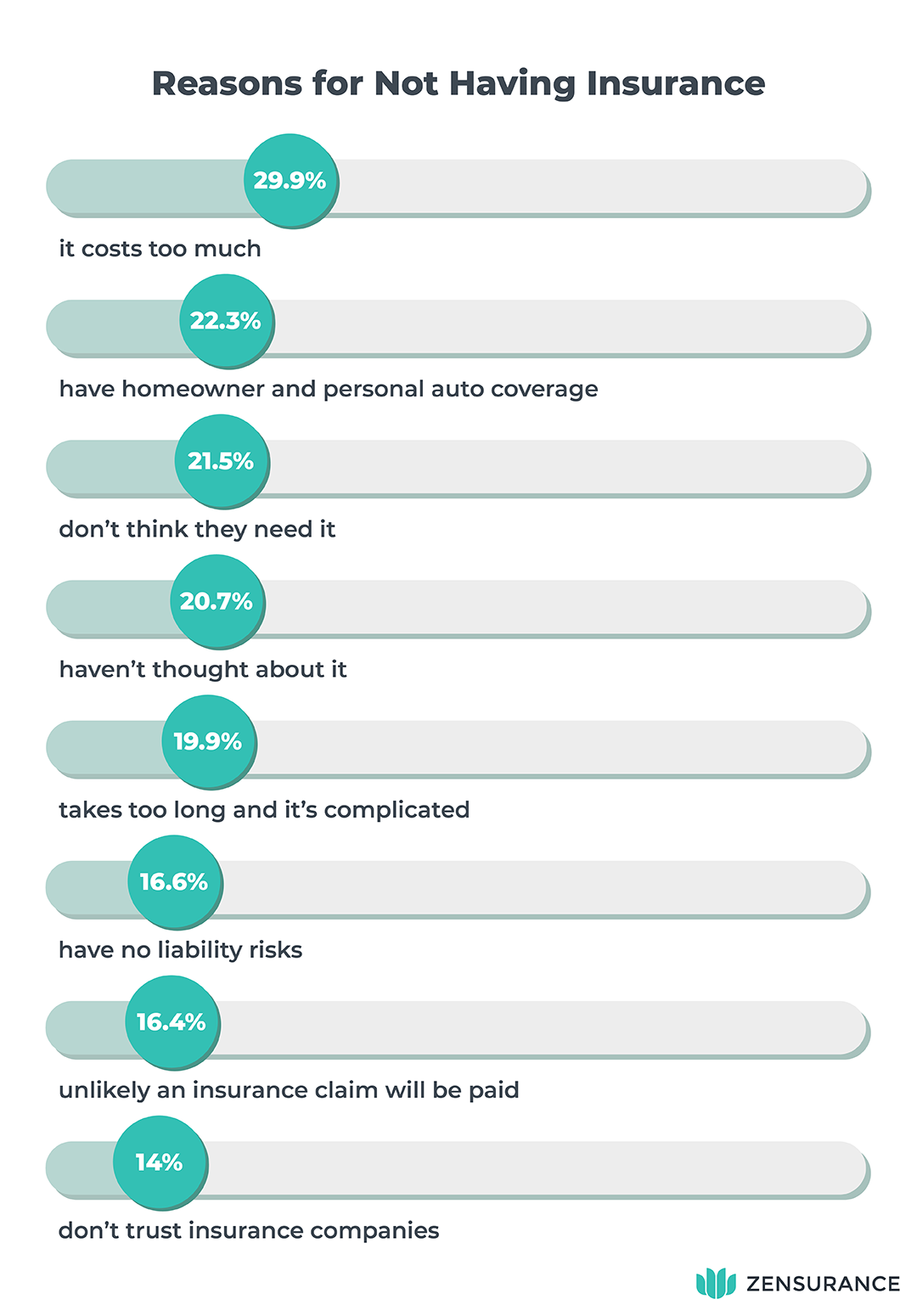

When we asked business owners who don’t have insurance why they don’t, 29.9% said it costs too much. Other reasons given for not having insurance include:

- 22.3% said they don’t because they have homeowner and personal auto insurance

- 21.5% said they don’t think they need it

- 20.7% admitted they haven’t thought about it

- 19.9% said it takes too long and it’s complicated to get insured

- 16.6% said their business has no liability risks whatsoever

- 16.4% think it’s unlikely an insurance claim will be paid

- 14% said they don’t trust insurance companies

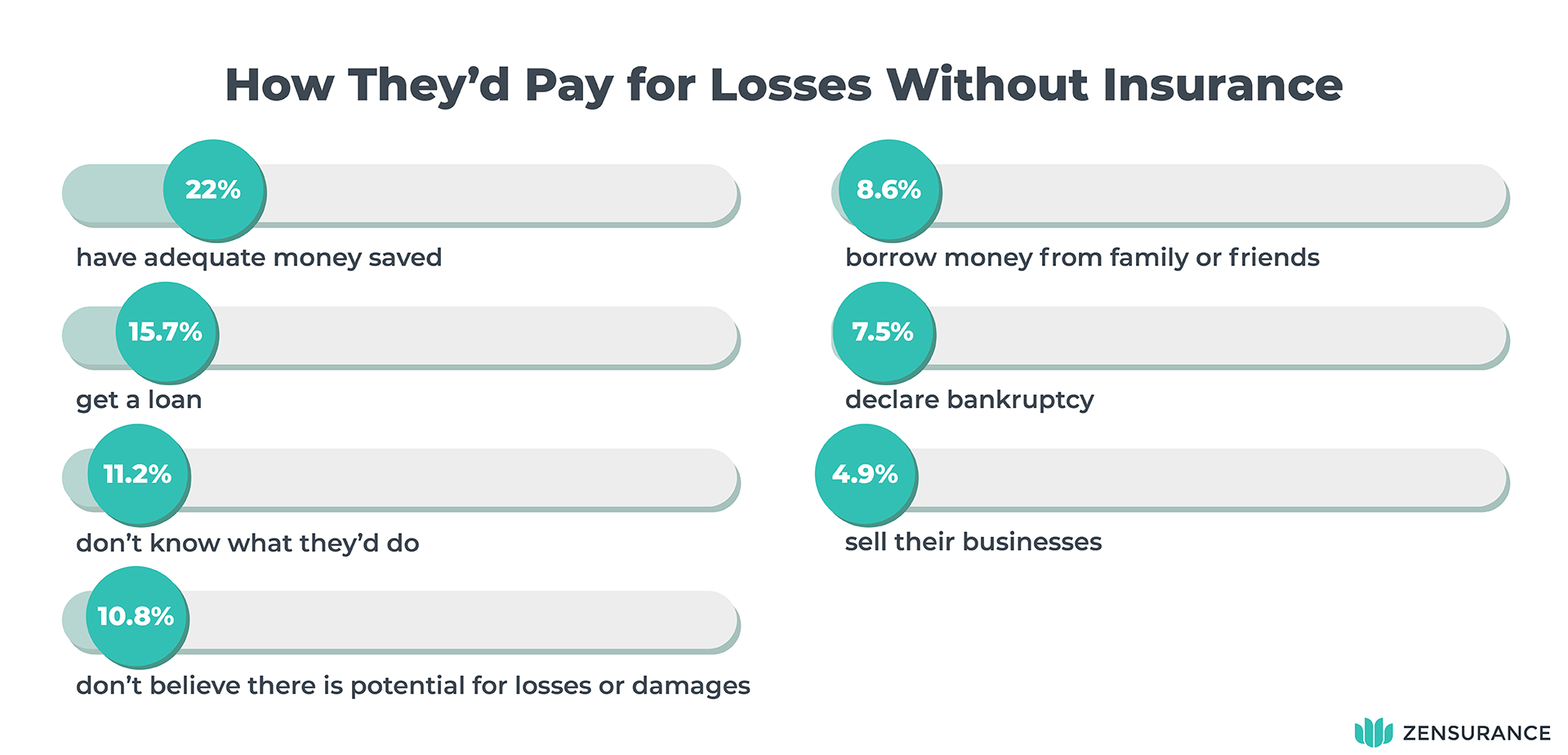

That led us to ask how they would pay for expensive damages or losses without a business insurance policy, such as a fire, flood, theft, vandalism, or a lawsuit. Most respondents (22%) said they have adequate money saved to cover expensive damages or losses. Other reasons our respondents gave include:

- 15.7% said they’d try to get a loan from a financial institution

- 11.2% admitted they don’t know what they’d do

- 10.8% said they don’t believe there is a potential for expensive losses or damages to their businesses

- 8.6% said they’d borrow money from family or friends

- 7.5% said they’d declare bankruptcy

- 4.9% said they’d sell their businesses

We also asked business owners if they have liability insurance to cover claims for selling products online through a third-party marketplace like Amazon. Most (47.9%) do, but 25.3% do not (26.8% said this question did not apply to them).

Again we asked how they would pay for expensive claims or lawsuits from customers who are injured or if their property was damaged by the products they sold. The results from online sellers without insurance were similar:

- 17.9% said they have adequate money saved to cover claims

- 11.2% would try to get a loan from a financial institution

- 9.6% don’t believe there is a potential for a claim or lawsuit against them

- 9.1% don’t know what they’d do

- 7.5% would borrow money from family or friends

- 5.7% would declare bankruptcy

Most Business Owners Who Filed Insurance Claims Were Paid

When we asked business owners if they’ve ever filed an insurance claim for their businesses, more than half (54.9%) said ‘no’, and 45.1% said ‘yes’.

As a follow-up question, we asked business owners who filed an insurance claim if their insurer paid their claim. Most (35.6%) of our respondents said ‘yes’, 13.2% said ‘no’, and 9.9% said their claim was still being investigated.

Identifying the Biggest Risks Small Business Owners Face

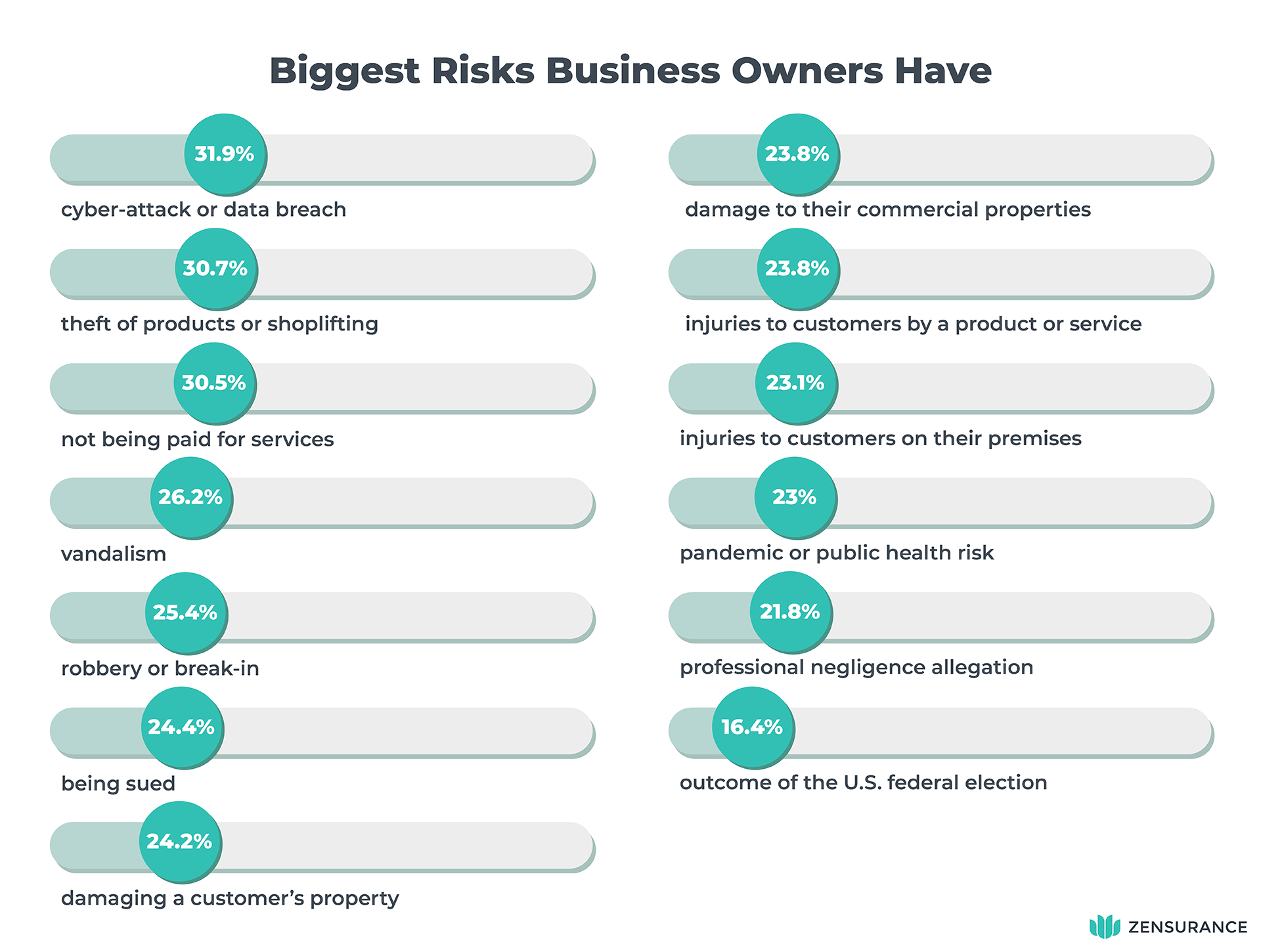

Considering no small business or profession is risk-free, we asked our respondents to highlight what they felt were the most significant risks to their businesses and finances. There are many.

A majority (31.9%) cited a cyber-attack or data breach. With cyber incidents and cybercrime a constant and increasing threat to organizations of all sizes and industries operating online or using a point-of-sale (POS) system, cloud storage, email, or website, this statistic is hardly surprising. However, only one in four small businesses have cyber liability insurance in their policies.

Business owners also highlighted other critical areas of concern to them that could hurt their bottom lines, including:

- 30.7% said theft of their products or shoplifting is their most significant worry

- 30.5% cited not being paid by a customer for their services

- 26.2% said vandalism to their property, business vehicle, or equipment

- 25.4% flagged a robbery or break-in at their business property

- 24.4% fretted about being sued by a customer or other party due to a disagreement or if they made a mistake. Interestingly, a Zensurance survey of Canadian consumers earlier this year found a majority of consumers would not hesitate to sue a small business if they or their finances were harmed in some way

- 24.2% said damaging a customer’s property concerns them

- 23.8% pointed to the possibility of damage to their commercial properties caused by fire, water, or a natural disaster like a wildfire

- An equal number of respondents (23.8%) said injuries to customers caused by a product or service they provide

- 23.1% said their biggest risk is the threat of injuries to customers or a third party on their premises

- 23% stated another pandemic or public health risk is a primary concern

- 21.8% are concerned about an allegation of professional negligence

- 16.4% worried about how the outcome of the upcoming U.S. federal election would affect them

Minimizing Potential Risks Top of Mind for Most Small Businesses

Encouragingly, most Canadian small business owners said they take action to minimize the potential threats to their financial wellness.

When asked what measures they take to protect their businesses and avoid the possibility of an insurance claim, almost half (43.3%) said investing in a monitored security and alarm system, followed by routinely conducting maintenance to their tools and equipment (37.6%), and training their employees on health and security best practices (35.8%).

However, it’s concerning to note that 13.6% of business owners do not take preventative measures to protect their businesses.

Nevertheless, emergency preparedness is at the top of most business owners’ minds. Other preventative measures business owners take to reduce the chance of damage or loss include:

- 34.9% conduct routine maintenance on their business properties

- 33.6% invest in cybersecurity measures

- 32.4% have a first-aid kit

- 26.1% regularly encrypt and backup their mission-critical data

- 24.7% have established a disaster recovery and business continuity plan

- 24.6% make it a point to remove debris and clutter from entranceways, aisles, and areas where customers and employees frequent

- 21.2% have installed a sump pump at their properties to prevent internal floods and water damage

Also, when asked if their businesses have experienced any damage or loss in the past five years, the good news is 33.4% said they have not. However, many have, with 37.5% saying they had equipment breakdowns (appliances, HVAC systems, machinery) due to an internal malfunction.

Highlighting other damages or financial impacts their businesses have endured in the past five years:

- 26.4% were held accountable for an injury to a customer or other third-party

- 23.5% said their business properties were damaged by either a fire, flood, internal water damage or a natural disaster

- 21.6% said they’d experienced theft or vandalism to their business properties or equipment

- 20.5% were hit by a cyber-attack or data breach

- 18.3% said their transportable tools and equipment (from handheld tools to heavy equipment like a bulldozer) were damaged

- 17% cited legal expenses related to debt recovery or employee or contract disputes

- 16% said they were sued for making a mistake, failing to deliver a service or copyright infringement

- 15.6% were involved in an auto accident or collision with their business vehicle

- 15.2% dealt with an allegation of professional negligence

Though the reasons these business owners suffered a financial loss or damage vary, it underscores the fact that no small business or profession is without risks that could cost them tens of thousands of dollars without a comprehensive business insurance policy.

Looking Ahead: What Plans Do Small Businesses Have This Year?

Given the remarkable optimism that most Canadian small business owners have of their prospects for success this year, we also asked what their plans are in the latter half of this year.

With the Bank of Canada recently making back-to-back quarter percentage rate cuts to lower its benchmark rate to 4.5% from 5% and inflation slowing to 2.7% in June, business owners may be buoyant about investing in their organizations.

Topping the list, almost half (47.1%) said they’d buy new tools, equipment, or electronics this year, 33% intended to hire more employees, and 32.5% would renovate their office or workplace. Meanwhile, 18.7% do not plan to invest in or change their businesses in 2024.

Of business owners that do intend to make changes, they include:

- 30.4% will introduce a new service or sell new products

- 23.8% planned to open a second office or storefront location

- 18.1% will move their businesses to a new location

- An equal number of respondents (15.2%) intend to lower their employee headcounts or move their businesses to another province

- 14.4% said they will move their businesses to the U.S. or another country

- 12.8% intend to sell or close their businesses

Other Thoughts Business Owners Have on Insurance and Being in Business

Knowing what they know about launching businesses, we also asked our business owner respondents what they would rather do than start a new business in 2024.

Most respondents (16.3%) said they’d work in a factory, followed by delivering food (11.7%), being a rideshare driver (11.3%), working as a retail greeter (10.6%), or working in a call centre (10.5%).

Other jobs existing business owners would pursue instead of launching a business in 2024 included working at a gas station (10%), being a professional ticket scalper (8.4%), selling shoes at a mall (8.3%), running a hot dog stand (7%), or being a sandwich artist (5.9%).

5 Facts About Business Insurance Every Small Business Owner Should Know

Regardless of the type of small business, independent profession, or side hustle business owners have, there are five critical things all should know about having a comprehensive business insurance policy:

1. Accidents, Unexpected Incidents, and Lawsuits Cost Significantly More Than Insurance

Insurance is an investment in your business’s financial welfare. For many independent professionals and small business owners, an annual premium may be as low as $19 a month for a policy with up to $1 million of liability coverage.

That’s significantly less than what a single accident, lawsuit, or an incident like a fire that engulfs your property and inventory will cost you. For example, the cost of defending yourself in a lawsuit launched by a customer or another party can cost tens of thousands of dollars. Also noteworthy, a separate survey found a combined 96.4% of Canadian consumers say it’s “very important” (79.7%) or “somewhat important” (16.7%) for small businesses to have insurance.

2. Homeowner and Personal Auto Insurance Aren’t Designed to Cover Business Liabilities

Homeowner insurance for your dwelling and private-passenger auto insurance for your personal vehicle is necessary. However, these policies either do not cover business-related liabilities, or their coverage limits may be insufficient, leaving you underinsured if you file a claim or a claim or allegation of wrongdoing is made against you.

Even a home-based business requires a commercial insurance policy to be adequately protected.

3. Insurance Is Vital For Your Business’s Financial Wellbeing

We’ve said it before, and we’ll repeat it: No business, profession, or side hustle is risk-free. Insurance serves as the backbone of every business continuity and risk management strategy.

In addition to protecting your finances and assets from damages and losses, it’s required to drive a business vehicle, lease a commercial property, get a loan, and, in many cases, adhere to your industry’s or province’s regulations. Also, the Canada Revenue Agency allows you to deduct all ordinary commercial insurance premiums you incur on any buildings, machinery, and equipment you use in your business.

Furthermore, having insurance protects your customers if something unexpectedly goes wrong, causing them physical or financial harm. Showing your customers a certificate of insurance builds their trust and confidence in you.

4. A Licensed Business Insurance Broker Works for You

That 19.9% of our survey respondents who don’t have business insurance said they don’t because it takes too long or is complicated is why you should partner with a licensed insurance broker.

A business insurance broker serves as your trusted advisor. They work for you, not an insurance company, and it’s their goal to get the adequate protection you need quickly at the lowest possible cost.

They provide objective risk assessments of your business or profession, advice on minimizing the risks you have to avoid suffering damages or losses and take the hassle of shopping for coverage to find the right type of coverage for you and customize it to suit your specific needs.

5. You Can Explore Your Insurance Options With a Free Quote

Finding out what your options are to protect your business doesn’t cost you a dime or a lot of time.

Fill out our online application for a free quote in less than five minutes.

Our experienced, knowledgeable brokers will shop our partner network of more than 50 insurers to find a low-cost policy that adequately addresses your liability risks.

Even if you already have business insurance, exploring your options by having our licensed brokers review your existing policy to see if we can beat what you’re paying now or enhance your coverage without a premium increase is worthwhile.

About the Zensurance Small Business Confidence Index

The Zensurance Small Business Confidence Index survey was conducted online from July 18 to July 22, 2024, polling 1,000 English-speaking Canadians who are self-employed, entrepreneurs, or small business owners.

Recent Posts

10 Tips for Renewing Your Commercial Auto Insurance

Is your commercial auto policy up for renewal or will it be soon? See our money-saving tips for what to do before renewing a policy to protect your business vehicle.

Do You Need Landlord Insurance to Rent Out a Room?

When renting out rooms in a boarding house or apartment, having landlord insurance is critical for protecting your investment and financial well-being. Here’s what you need to know.

What Type of Insurance Do Human Resources (HR) Professionals Need?

The diverse responsibilities of HR professionals contribute to a company’s growth and success. But they also open the door to potential liability risks. Here’s how HR practitioners can safeguard their careers and finances.